Many consumers worry about their future of bankruptcy and wealth after they file bankruptcy. However, banks have found consumers who file bankruptcy are far more wealthy. Persons who fail to file bankruptcy as a financial tool when it is necessary to lose money! The decision to file bankruptcy needs to be based on when does it make sense to do it financially.

Bankruptcy and Consumer Wealth

The Federal Reserve Bank of New York and a second Philadelphia banking report the following findings below.

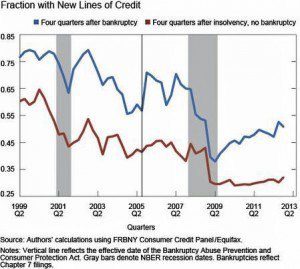

⎆ People who file bankruptcy have more new lines of credit than those who continue in a poor financial state.

People who file bankruptcy are able to purchase cars and homes shortly after bankruptcy. Conversely, those who don’t file bankruptcy continue to have bad credit. Then, that bad credit leads to the inability to purchase at normal prices and interest rates. Additionally, people with bad credit pay more for homes, cars, and major consumer items. However, filing bankruptcy gives the consumer opportunities to lower insurance rates, a lower price for homes and cars, and access to the credit necessary to purchase these items. Within a year that they start to get market rates on car financing, and within two to three years they qualify for good mortgage rates.

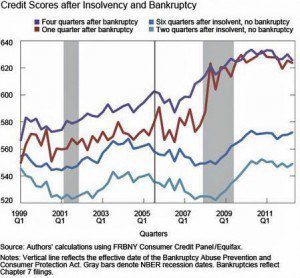

⎆ Those who file bankruptcy see a rapid improvement in their credit score when compared to those who continued to struggle with debt.

According to the FRBNY. Individuals who go bankrupt experience a sharp boost in their credit score after bankruptcy.

“. . . The recovery in credit score is much lower for individuals who do not go bankrupt.” —Federal Reserve Bank of New York.

Our analysis suggests the 2005 bankruptcy reform negatively affects individuals who become delinquent by increasing the probability that they would become insolvent, a state associated with a high degree of financial distress.

Essentially people who don’t file bankruptcy simply hurt themselves by living longer with poor credit. They pay more for their homes, cars, insurance, and everyday items. They are also unable to obtain credit at reasonable rates. Additionally, they are unable to save for retirement or repay the debt because of these higher rates and costs.

⎆ People who don’t file bankruptcy lose Consumer and Retirement Wealth.

“We show insolvent individuals who do not go bankrupt exhibit more financial stress than those who do, suggesting these individuals would likely prefer to file for bankruptcy if they could afford it.” —HuffPost

The most disturbing reality about not filing bankruptcy is the significant amount of retirement income lost by people who avoid filing. A 25-year-old debtor who invests $300 per month for five years into a retirement plan instead of a debt settlement program or limps along making minimum payments. They repay their debt but repaying costs them $23,231.12. In retirement funds, this is worth $1,247,526.55 when they eventually retire at age 70. A 45-year-old would lose $170,239 in future retirement funds.

The person who repays the debt settlement plan instead of filing bankruptcy loses. People must learn to properly budget and pay themselves first by fully funding the retirement they need later. In most cases, the person that repays through these debt settlement plans fails to complete the plan and ends up owing more than when he or she started the program. 95% of these debt settlement plans fail to leave the person worse than when they start the program.

Resources for Bankruptcy

Louisville Kentucky Bankruptcy Forms

Other Related Information

Bankruptcy and Understanding Psychological Health

Retirement Benefits & 401k in Bankruptcy

Kentucky Bankruptcy Exemptions Keep Your Property

If you are thinking about filing bankruptcy, don’t delay because timing is crucial. I am here to help you. So, contact my office right away to start the conversation. Nick C. Thompson, Bankruptcy Lawyer: 502-625-0905