Bankruptcy Overview

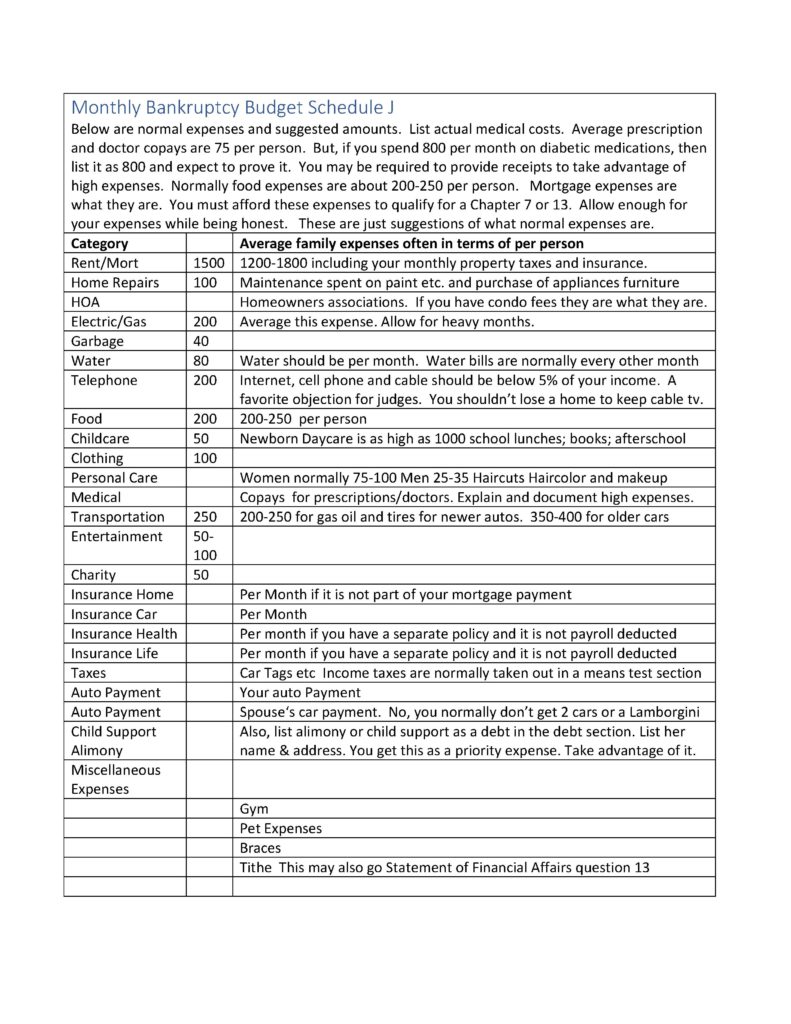

Bankruptcy gives individuals and businesses a fresh start by eliminating or restructuring their budgets and debts. There are five types of bankruptcy, but consumers primarily file Chapter 7 and Chapter 13. A sample of a 2015 budget is below, but remember to always use your actual expenses in your budget. People often forget expenses that will allow them either a lower Chapter 13 bankruptcy payment or allow them to qualify for a Chapter 7.

What is Chapter 7 Bankruptcy?

Chapter 7 bankruptcy, also known as liquidation bankruptcy, rarely involves selling a debtor’s non-exempt assets to pay off creditors. In exchange, the debtor is discharged from most of their debts, except for certain non-dischargeable debts such as taxes, student loans, and child support. This type of bankruptcy is typically the fastest, cheapest, and most common, with cases usually taking 3-5 months.

What is Chapter 13 Bankruptcy?

Chapter 13 bankruptcy is known as a reorganization bankruptcy; it involves catching up on mortgages and a repayment plan to pay a percentage or portion of a debtor’s unsecured debts over time. In exchange, the debtor is allowed to keep a limited amount of equity in their assets and avoid foreclosure or repossession.

This type of bankruptcy is used by individuals who have a steady income and want to keep their assets but need help to manage debt. The repayment plan lasts 3 to 5 years.

Qualifying for Chapter 7 Bankruptcy

- The means test determines if you qualify for Chapter 7 bankruptcy by evaluating your current monthly income. It uses the average income and expenses for your area and your size family as determined by the IRS. It has two parts if you don’t pass the first test you will often pass the second.

- You must pass the means test to qualify for Chapter 7 but over 90% of debtors pass.

- It calculates your gross income to determine eligibility for the prior six months.

- Your average monthly income must be below the state median to qualify for Chapter 7 in the first part of the test. People with primarily business debt or disabled veterans are often exempt from this test.

- You must have little (below 150 dollars or so) or no disposable income to repay unsecured debts after deducting for reasonable and necessary expenses.

Chapter 7 Income Limits and Means Test

The means test considers a debtor’s gross income, essential expenses, and priority debts to determine whether they have disposable income that can be used to pay off creditors. If a debtor’s income is too high, they may not qualify for Chapter 7 bankruptcy and may need to file for Chapter 13 instead.

You may want to sell nonexempt property if you have too much property. People often pay for repairs and maintenance on property they need to keep.

Calculating Disposable Income for Bankruptcy

- Calculate your gross income by adding the prior six months of family income, divide by 6 to get your monthly income and multiply that by 12 to get your estimated annual income.

- Determine your allowed deductions, including necessary expenses and secured debts. Secured loan payments are considered necessary expenses that must be paid to maintain a basic standard of living.

- Disposable income is the amount left over after paying necessary expenses and secured debts

- You must have little to no disposable income to qualify for Chapter 7 bankruptcy. This is generally less than 150 per month.

Of course I do this for free when you come in to prepare a petition. The bankruptcy means test is difficult to calculate because it also uses and compares your expenses to the IRS national average monthly income and expenses at the filing date.

Essential Expenses

Essential expenses are necessary expenses that a debtor must pay in order to maintain a basic standard of living. Always use your actual expenses but we tend to use the actual expenses. If your medical or housing expenses are large, the Trustee tends to use a policy of trust but verify and may request your receipts. These expenses in 2025 include:

- Rent or Mortgage payments 1500-2500

- Utilities Gas and Electric should be about 250 but use the actual

- Food 300-400

- Transportation costs 300 per car

- Car payments

-

Approved Chapter 7 & 13 Budgets Medical expenses

- Child care costs

- Education expenses

Debtors may deduct these expenses from their gross income to determine their disposable income.

Reducing Disposable Income

Debtors are able to reduce their disposable income by deducting reasonable and necessary these same expenses. By reducing their disposable income, debtors will either qualify for Chapter 7 bankruptcy or reduce the amount they must pay in a Chapter 13 repayment plan.

Key Deductions to Reduce Disposable Income

Key Deductions to Reduce Disposable Income

When evaluating whether to file for Chapter 7 or Chapter 13 bankruptcy, consider if your monthly consumer debt payments exceed 40% of your take-home pay. In Chapter 13 bankruptcy, unsecured consumer debts can be discharged. Codebtors can be protected in 100% plans, preventing creditors from pursuing co-debtors for these debts.

- Necessary expenses, such as housing and utilities are allowed expenses

- Transportation costs, including car loans and insurance are allowed expenses

- Secured debt payments, such as mortgages and car loads are allowed expenses.

- Child support and domestic support obligations are allowed and can be paid before unsecured debts in a Chapter 13 bankruptcy.

- Payments on car loans are normally allowed. Interest rates may be reduced for auto loans. If the auto loan is over 910 days the loan may be separated into two parts a secured auto loan and an unsecured debt for any part of the loan above the value of the auto.

- Unsecured debt payments, such as credit card debt may be paid anything between 1 and 100%. But the debtor must tighten his belt just as the creditors have to tighten their belts.

Chapter 13 Bankruptcy: Eligibility and Requirements

- You must have a regular income to qualify for Chapter 13 bankruptcy.

- Child support payments are considered a priority debt that must be listed as a debt and addressed in the repayment plan.

- Your debts must be within the Chapter 13 limits which are about 1.5 million.

- You must complete a credit counseling course and the debtor education course for the discharge.

- You must have a plan to repay a portion of your debts.

- You must make regular payments to a bankruptcy trustee.

Creating a Chapter 13 Repayment Plan

You’ll create a plan to repay the unsecured debts back a portion of the debt.

The plan will almost always last for 5 years in our Western District of Kentucky

You’ll make monthly payments to a trustee

The plan must show how it provides for payments to secured creditors and unsecured creditors. Secured loan payments must be managed carefully to retain collateral assets such as your home and car. The plan will be detailing processes for submitting payment plans and making adequate protection payments to secured creditors during the bankruptcy process.

The plan must be approved by the bankruptcy court orders which confirms the plan. Judge Lloyd in our district will always hold a confirmation hearing after the 341 meeting. The 341 meeting is before a trustee who is either a lawyer or CPA who conducts a short 5 minute deposition and review of the bankruptcy petition.

Chapter 13 Plan Confirmation and Completion

The bankruptcy judge will review and confirm your plan (approve)

You will often attend a confirmation hearing.

You’ll receive a discharge after completing the plan payments. You do have to take the second class and fill out a one page form asking your address and place of employment at the end of the plan. This request for discharge is required in a Chapter 7 case.

You must complete the plan to receive a discharge. The failure to make payments to the trustee will mean that the case is dismissed. The failure to make required payments to the mortgage or car loan will allow them to file a motion to terminate the stay. This allows them to return to a foreclosure court or pick up the auto. They will often require you to pay their attorney fees and filing fees plus catch up payments to keep the home if you fall behind in payments to them. During the plan, it is crucial to maintain secured loan payments to keep assets and ensure plan confirmation.

You may be eligible for a hardship discharge if you’re unable to complete the plan

Failing the Means Test: Alternative Options

Failing the Means Test: Alternative Options

If your Chapter 13 budget fails the means test you are almost always eligible for Chapter 13 bankruptcy. If need to file for Chapter 13 bankruptcy your payment may be so small that it may not be an issue.

Some people reduce their income for a couple of months which may allow them to file as a Chapter 7 later. If your income is seasonal this is a real option.

You may be able to appeal the means test decision if there are special circumstances.

You may need to consider other debt relief options, such as debt consolidation or credit counseling.

Understanding Chapter 13 Discharge

You’ll receive a discharge after completing the Chapter 13 plan. However, you may still be responsible for certain debts, such as child support payments, student loans and taxes. The major issues with Chapter 13 bankruptcy court is that you must maintain the payments. By including all of your expenses the payment may be small but all chapter 13 bankruptcy cases must:

- Repay what Chapter 13 would have repaid. (what the Chapter 7 trustee would have repaid if he sold any non-exempt property).

- Repay to the best of your ability any disposable income. (what you can afford)

- Repay the amount to bring current any secured debt for the property you retain or the priority debt you owe. (child support and taxes less than 3 years old)

You may be eligible for a hardship discharge if you’re unable to complete the plan.

The discharge will release you from liability for most debts.

Bankruptcy Budgeting Tips unsecured creditors and consumer debt

- Create a realistic budget to ensure plan success. People often forget daycare in these budgets and other necessary expenses. When creating your budget, remember your unsecured creditors are no longer a concern. They are gone.

- You have to live on your current monthly income. Compare it to normal expenses for the median income of your community. This is about getting debt-free, not just an attempt to determine eligibility for Chapter 7 or Chapter 13 bankruptcy.

- Prioritize necessary expenses and debt payments. You must pay for your needs, not your wants.

- Monitor and adjust your budget as needed

- Consider seeking the help of a bankruptcy attorney or credit counselor

Conclusion: Navigating Chapter 7 and 13 Budgets

Understanding bankruptcy budgets and eligibility is crucial for success. Properly managing a budget will allow you to qualify for the Chapter 7 or 13 you need.

Preparing a good bankruptcy filing is essential to meet all procedural requirements, such as credit counseling and form completion. But you can file a Chapter 13 or a Chapter 7 and still fail if you don’t change how you deal with money and debt.

I can prepare a perfect bankruptcy petition. But I cant change how people handle money after they file bankruptcy. A Chapter 7 may eliminate debt. But if you return to borrowing personal loans and overwhelming debt after a discharge your Chapter 13 or Chapter 7 wont help in the long run.

Consult with a bankruptcy attorney to determine the best course of action. Make sure to follow the bankruptcy code and means test guidelines. Create a realistic budget and prioritize necessary expenses and debt payments.

Sample 2015 Budget