When a person or company files for bankruptcy, their assets and finances are often subject to scrutiny in order to fairly distribute funds to creditors. One aspect of bankruptcy law that can significantly impact individuals and businesses is the concept of a bankruptcy clawback. In this article, we will explore what bankruptcy clawback is, its types, its implications, and how to navigate potential clawback actions.

Bankruptcy Clawback: What is it?

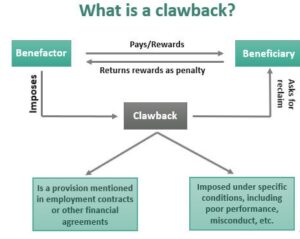

A bankruptcy clawback is a legal mechanism that allows the bankruptcy trustee to recover assets or funds that were transferred by the debtor before filing for bankruptcy.

These transfers are often made to preferential creditors or involve fraudulent activities. The clawback process seeks to ensure fair distribution among all creditors.

Types of Bankruptcy Clawbacks

There are two main types of bankruptcy clawbacks: preferences and fraudulent transfers.

Preferences

A preference occurs when a debtor favors one creditor over others by transferring assets or paying off debts shortly before filing for bankruptcy. Preferences typically involve paying off a specific creditor in full, while other creditors receive only a portion of what is owed to them.

Fraudulent Transfers

Fraudulent transfers, on the other hand, involve intentionally moving assets or funds out of reach from creditors. These transfers are made with the intention of defrauding creditors and hindering the bankruptcy process.

Elements of a Clawback Action

To successfully initiate a clawback action, certain elements must be proven by the bankruptcy trustee. These elements typically include:

- The transfer was made within a specific time frame before the bankruptcy filing.

- The debtor was insolvent at the time of the transfer.

- The transfer provided the recipient with more than they would have received through the bankruptcy process.

- The debtor had the intention to hinder, delay, or defraud creditors through the transfer.

Avoiding Clawback Actions

If you are concerned about potential clawback actions, there are certain strategies you can employ to minimize the risk. Working with a knowledgeable bankruptcy attorney can help you navigate these strategies, which may include:

- Properly documenting all transfers and payments made prior to bankruptcy.

- Ensuring that transfers are made in the ordinary course of business and for fair value.

- Seeking professional advice before making any significant financial moves.

Defenses Against Clawback Claims

If you find yourself facing a clawback claim, it is essential to understand the potential defenses that may be available to you. Some common defenses against clawback claims include:

- Ordinary course of business defense.

- Contemporaneous exchange for new value defense.

- Good faith defense.

- Statute of limitations defense.

Statute of Limitations

Clawback actions are subject to a statute of limitations, which limits the time within which a trustee can initiate a clawback claim. The length of the statute of limitations varies depending on the jurisdiction and the type of clawback action.

Impact of Clawbacks on Creditors

Clawback actions can have significant implications for creditors. Successful clawback claims can result in the redistribution of assets or funds, potentially increasing the recovery for other creditors. However, if you are on the receiving end of a clawback claim, it can lead to financial losses.

Examples of Famous Clawback Cases

Over the years, several high-profile clawback cases have made headlines. One such example is the Bernie Madoff Ponzi scheme, where the bankruptcy trustee aggressively pursued clawback actions to recover funds for the victims of the scheme.

Recent Developments in Clawback Law

Clawback law continues to evolve, with courts and legislators addressing new challenges and refining the legal framework. Staying informed about recent developments can help individuals and businesses better understand their rights and obligations in bankruptcy proceedings.

| Pros of Clawback Actions | Cons of Clawback Actions |

|---|---|

| Recovery of funds for creditors | Time-consuming process |

| Deterrence of fraudulent activities | Expensive legal proceedings |

| Promotes fair distribution of assets | Complexity of clawback actions |

| Provides accountability for debtors | Additional challenges for debtors |

| Protects the integrity of the bankruptcy process | Potential financial losses for clawback targets |

Conclusion

Bankruptcy clawback is a crucial aspect of bankruptcy law aimed at ensuring fair distribution of assets among creditors. Understanding the types of clawbacks, seeking professional’s help their elements, and potential defenses can help individuals and businesses navigate the complexities of the bankruptcy process.

FAQ

Q: Can I prevent a clawback action by transferring my assets to a family member or friend?

Transferring assets with the intention to hinder or defraud creditors can be deemed fraudulent and may still be subject to clawback actions. It is crucial to seek legal advice and follow the proper procedures when dealing with asset transfers before bankruptcy.

Q: How long does a trustee have to initiate a clawback action?

The statute of limitations for clawback actions varies depending on the jurisdiction and the type of clawback. Consult with a bankruptcy attorney to understand the specific time limits that apply in your case.

Q: Can I negotiate with the bankruptcy trustee to avoid a clawback action?

In some cases, it may be possible to negotiate with the bankruptcy trustee to reach a settlement and avoid or reduce the impact of a clawback action. Working with an experienced attorney can help you explore possible negotiation options.

Q: Are there any alternatives to bankruptcy clawbacks for debtors?

Debtors facing financial difficulties should consult with a bankruptcy attorney to explore alternatives to bankruptcy, such as debt restructuring, negotiation with creditors, or debt consolidation. These alternatives may help avoid the need for clawback actions.

Q: Can creditors pursue their own clawback actions against a debtor?

In certain situations, creditors may be able to initiate their own clawback actions against a debtor. The specific conditions and procedures vary depending on the jurisdiction and the nature of the claim. Consult with legal counsel for advice tailored to your circumstances.