Bankruptcy Filing Time Limitations

You can only file bankruptcy as a Chapter 7 and get a discharge every eight years after the prior Chapter 7. This time runs from the date the first case was filed until the second one was filed. You can file a Chapter 13 the day after your Chapter 7 case closes to stop a foreclosure. But, you will not get a discharge in the second Chapter 13 case without waiting any necessary time.

Bankruptcy filing limitations usually require you to wait years after one discharge until your next discharge. The court may issue a discharge only after determining all obligations have been met. This determination is made at the end of Chapter 13 by filing a request for a discharge.

You still get the benefit of the stay by filing a Chapter 13 after Chapter 7. This allows you to manage a foreclosure, student loan, or income tax debt over three or five years. But the stay is a temporary order during these five years, allowing you up to five years to catch up on the debt.

You can stop a foreclosure with Chapter 13 even if you can’t get discharged. The stay stops foreclosure, tax, and student loan collections for up to five years. You can cure the foreclosure, tax, or student loan problem during this time. The stay prevents foreclosures and IRS or Student loan garnishments from collecting. Sometimes, this allows paying little or nothing to the debt for a period of years.

Bankruptcy Filing Time Limitations

If you need to strip a second mortgage, you have to get the discharge in Chapter 13, which can strip a second mortgage with no equity. We often file Chapter 7 first to eliminate unsecured debt so that no unsecured debt is repaid in Chapter 13. Any such claim must be validated during the bankruptcy proceedings.

When you file a Chapter 7 or Chapter 13 bankruptcy, a stay goes into effect. The stay is a temporary court order. Your goal usually is to get the permanent court order called a discharge at the end of the case. But you may often not need the discharge if you are only concerned with catching up on the mortgage.

You can only obtain one discharge every few years. But you can file a Chapter 13 whether you get a discharge or not. A Chapter 13 stay allows you to manage debts that survived Chapter 7. Since the stay in Chapter 13 lasts 3-5 years, you have time to pay off a Student loan, foreclosure, or priority tax debt. The timing of debt discharge is crucial. Dates can impact the property values under the bankruptcy plan.

Filing Time Limits for Bankruptcy

Overview of the General Time Limits for a Discharge

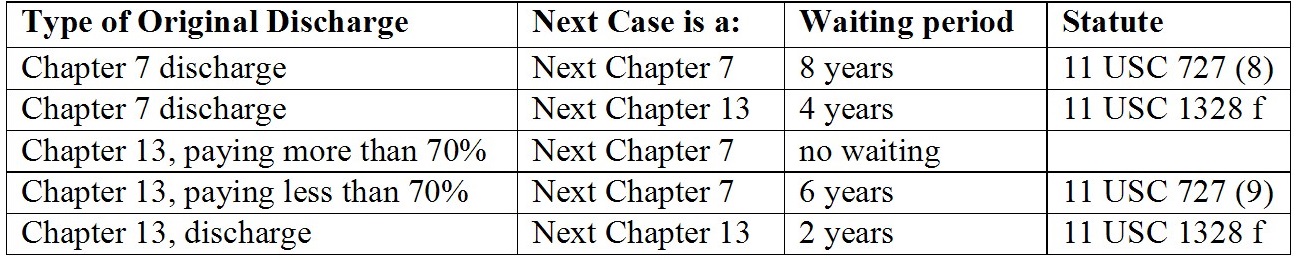

Bankruptcy filing time limits vary depending on the chapter and type of bankruptcy. Generally, debtors have a waiting period to file their next bankruptcy case. A debtor files a request for discharge at the end of a Chapter 13 case to have the discharge executed after completed payments.

There is no United States code section that requires you to file a request for discharge in a Chapter 7 case. There is generally no notice and a hearing to get the discharge. However, you must file your debtor education class’s personal financial management certificate to obtain the discharge.

Debt incurred after Chapter 13 was filed is not dischargeable unless you convert from Chapter 13 to Chapter 7. Additionally, debts related to a debtor’s conviction are not dischargeable. The primary dates to remember are that the waiting periods run from the date filed to the date the next case is filed. It is not from the date of discharge to the date of discharge. But there is no waiting period to file a Chapter 13 if you only want to stop the foreclosure and give yourself time to catch up.

Specific Time Limits for Different Bankruptcy Chapters

Different chapters of bankruptcy come with their own set of time limits for refining. It is essential to understand the limits for effective bankruptcy and financial planning. If you filed for Chapter 7 bankruptcy, you must wait eight years from the date of your last filing before you can file for Chapter 7 again and receive a discharge. The waiting period is four years if you are considering filing for Chapter 13 after a Chapter 7 discharge.

Chapter 13 bankruptcy has its own set of rules. If you have completed a Chapter 13 plan and received a discharge, you must wait two years before filing for another Chapter 13. However, if your Chapter 13 plan paid less than 70% of your unsecured debts, you must wait six years before filing for Chapter 7. Unsecured debts provided in Chapter 13 plans can be discharged under certain conditions, including procedural requirements and exceptions related to specific types of non-dischargeable debts.

Understanding these specific time limits is vital for anyone considering bankruptcy. It ensures that you can strategically plan your filings to maximize the benefits and protections offered by bankruptcy law. Always consult with a knowledgeable bankruptcy attorney to navigate these timelines effectively and make informed decisions about your financial future.

Debts incurred for a criminal fine, domestic support obligation, willful or malicious injury, or educational loans.

Priority and nondischargeable debts are not allowed a discharge. A willful and malicious injury or drunk driving accident claim may be managed or discharged by the failure to object to a Chapter 13 plan. To discharge what is normally a non-dischargeable debt, you must give full notice to the creditor.

Debts caused by willful and malicious conversion are as nondischargeable as a willful personal injury. The debtors incurring a debt just before filing may be just as fraudulent, making a debt non-dischargeable. Debts for restitution or for a criminal fine cannot be discharged. The debtor remains responsible for these obligations even after the bankruptcy process is completed.

The failure to object tends to run from the effective date the objecting or moving party gained knowledge or notice. You are the requesting party when you file the plan. Any allowed claim will be held to the terms of the plan and order of confirmation. Espinosa held even if a debt, such as a student loan, is not dischargeable; the debt may be modified or discharged if the court approves the plan and allows a discharge. Bankruptcy law will require notice and a hearing to be given to a creditor. But bankruptcy law does not reward creditors who ignore the order for relief, fail to file an objection, and later complain.

Bankruptcy Filing Time Limitations Filing a Chapter 20 objecting to an allowed claim filed

You can file a Chapter 7 before filing a Chapter 13 to eliminate what would be an allowed unsecured claim in Chapter 13. An allowed unsecured claim in Chapter 13 must be paid a percentage in the plan or be objected to and disallowed.

Filing Chapter 7 first sets up all of the debts at the choice of the debtor to be allowed in the plan or disallowed as a prior discharged debt. If a discharge was obtained through fraud, it may be revoked upon request. A debtor who properly plans and times a Chapter 13 properly will often avoid fraud claims. This gives such debtor the relief and discharge they need.

Chapter 7 Filing problems

Sometimes, refiling is so important that a debtor may reopen an old case and request that the discharge be set aside so a new case can be filed. You can voluntarily dismiss Chapter 13, but dismissing Chapter 7 requires prior Trustee approval.

The court may grant a discharge only if the debtor meets specific conditions, including the proper listing of debts, assets and compliance with court orders.

You usually will not obtain this prior approval if the debtor fails to list an asset. A Chapter 7 Trustee will administer the estate to earn a fee from liquidating non-exempt assets. The court determines whether forgetting an asset is fraud. But if a discharge is granted in Chapter 7, the eight-year waiting period will still be required before you can file another Chapter 7.

Exceptions to Filing Time Limits

In certain circumstances, the court may grant a hardship discharge if a debtor has not completed all payments under the bankruptcy plan. This exception is not granted lightly. It requires the debtor to demonstrate that their failure to complete the payments was due to circumstances beyond their control. For instance, if a debtor faces unexpected medical emergencies or sudden job loss, the court may consider these as valid reasons for not completing the payments.

The court exercises discretion in these cases. It will carefully evaluate the debtor’s situation to determine if the failure to make such payments is justifiable. The debtor must show good cause, and the court will require substantial evidence to support such a claim. This process often involves a notice and a hearing, where the debtor presents their case. The court decides based on the merits of the situation before it reaches such determination.

This exception is not a loophole to avoid payments. It’s a provision in bankruptcy law to offer relief in unavoidable circumstances. Debtors seeking such waiver should know the subsection permits a hearing the court needs to get the hardship discharge granted. You will have to prove a personal injury or overwhelming problem prevented you from completing the plan to get the hardship discharge granted. The debtor’s failure to complete the plan or other provision must not be the debtor’s fault.