Can I File Bankruptcy Without My Spouse Knowing?

If your question is, can I file bankruptcy without my spouse, then yes is the answer. The bankruptcy court or the trustee does typically not contact a spouse when you file bankruptcy. Unless you tell your spouse you filed for bankruptcy, they will typically never know about your filing bankruptcy.

If you share the debt with your spouse, the creditor may advise them that you have filed. To file bankruptcy, you will need the records of your spouse’s income used in the means test.

But your attorney, the court, and the trustee keep your bankruptcy case and the information as a confidential relationship. It is possible that you had a preferential transfer or fraudulent transfer of assets to the spouse before filing. Then you have involved your spouse in the court process.

The fact that you filed is a public record, and they can look it up. But how many people read obituaries and bankruptcy filing for a hobby. Usually, people don’t care if you file for bankruptcy.

The Purpose of the Filing Should Determine Whether a Spouse Files With or Without You

If you are trying to stop a foreclosure, it is best to file without your spouse to protect property owned with joint debts. If you make a mistake and the mortgage company files a motion for relief from stay, you can have your spouse file a second bankruptcy case to save the home. You lose that right when you file jointly. People can’t dismiss a car and refile for six months after a motion for relief from stay.

You probably have both joint debt and jointly owned property. Your property is part of the bankruptcy estate. Their separate property is just that, a spouse’s separate property. It is not available to the trustee to pay for your debt. In your bankruptcy case, you want to protect marital property, which is just a part of proper bankruptcy planning.

Does Your Filing Affect the Spouse’s Credit?

If a debt is not paid and it is joint debt, and you file without your spouse, it will be reported on your credit file as an account closed. It will be reported on the spouse’s credit report as delinquent debt. They don’t get the advantage of having their credit improved unless the spouse filed bankruptcy with you.

A bankruptcy case will only have good effects on the people who filed. What hurts a spouse’s credit is whether or not the debt was paid on time, not whether or not you filed for bankruptcy.

Your spouse’s income is used to determine the amount of your Chapter 13 payment and whether you can file as a Chapter 13 or not in the means test.

Community Property States

Many of the states which were initially Spanish are community property states. In these community property states, the debt of a husband also belongs to the wife. There are no separate property rules. A bankruptcy attorney has to be careful in how the bankruptcy is filed not to affect the non-filing spouse in a community property state. The bankruptcy estate in these states includes the property of the non-filing spouse.

You can file bankruptcy in these states, but the spouse’s property is your assets. And your debts, such as student loans, are not separate but are owed by them.

This is the opposite of how property and debts are treated in Kentucky. Married couples get a much better deal in our state as there is no common law property. If you are not married, you must be on the title to own it. If you exempt your home, it must be the same house you reside in, whether you live in a community property state or not. Your bankruptcy is concerned with your property and debts. If your spouse files their bankruptcy discharge in bankruptcy concerning their property acquired and their debts.

Should I file Separately or Jointly with My Spouse?

An individual bankruptcy filing is much cheaper than filing jointly. In many cases, the non-working spouse has little or no debt. Filing bankruptcy raises and does not lower a credit report score. When you file bankruptcy, what was delinquent debt becomes reported as an account closed. Your credit report improves typically. When you file without your spouse, and your spouse had bad credit, the spouse’s credit report does not improve.

When people have good credit (700+), filing bankruptcy at most drops the score about 50 to 75 points. If you have a 500 -600 credit score, your credit will generally improve by filing. People with a 650 or higher score can buy a new car or home.

Your bankruptcy attorney should review your options, and filing bankruptcy without your spouse may or not be a good choice. When it is a good choice to file bankruptcy without your spouse, don’t let emotions keep you from making a good financial decision. The attorney-client relationship requires the law firm to discuss both pros and cons and how filing bankruptcy will affect you.

If I File Bankruptcy, Does My Spouse Have to File?

No. Not at all. But if they don’t get the benefits of a bankruptcy discharge or stay if they need it. Many couples keep their finances separate. You can file bankruptcy without a spouse. But the decision should rest on what is most beneficial. Exemptions only protect your property. If you transfer property, you lose your exemption and may cause a fraudulent transfer.

A separate spouse’s property or a spouse’s interest is separate from your property. They don’t lose it just because you filed. You don’t want a joint filing when they have too much equity. I would file without my spouse if filing jointly means the bankruptcy trustee can take property.

Filing Bankruptcy Without Your Spouse and When Assets are at Risk

The bankruptcy case does not require a non-filing spouse to join. If the spouse’s debts are small, it may be better to pay debts. Assets might be marital property in divorce court if they were partially paid for during the marriage. But in bankruptcy, property acquired as separate property and owned in title solely by the spouse protects that asset. A car loan solely in the spouse’s name is not affected by your filing without your spouse.

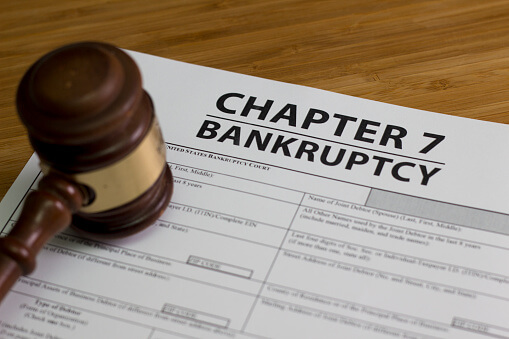

A spouse’s assets are only at risk if they are joint property. Joint assets mean that the Debtor’s creditors or Trustee can attach half. The Trustee has the same powers as if he filed debt collection lawsuits and obtained a judgment. Joint property may be at risk in Chapter 7, but it is not at risk in Chapter 13, where you can voluntarily dismiss a case. If the property is at risk of being sold in Chapter 7, you cannot voluntarily dismiss a Chapter 7 case.

What Effect Does My Filing for Bankruptcy Have on My Spouse’s Credit?

Your spouse’s credit score is only affected if they filed the bankruptcy or the debt is not paid on time. I want to be careful when I file bankruptcy without my spouse. I want debt relief, but I have to go home someday. Debt relief may or may not be as important as preventing a divorce. Typically your filing does not affect your spouse’s credit rating unless there are co-signed debts.

Sensitive or confidential information is kept confidential in bankruptcy. If you file bankruptcy without your spouse, they remain responsible for their debts. Married couples usually do not file without a spouse. The bankruptcy affects the couple, and it is best to work together to solve problems. Usually, a spouse expects to borrow money with you and file for bankruptcy jointly. Proper planning may mean only one person filing is best or that the spouse’s interest is best served when you file bankruptcy separately.

Is My Spouse Liable for My Debts if I Don’t Pay?

Your spouse is liable only if they sign for the debt. Your spouse is not liable for your debts because you didn’t pay in Kentucky. If they are asked to pay by a creditor for a non co-signed debt, the creditor has violated your right to privacy and probably the fair debt practices act. It helps to record such calls and contacts.

The exact opposite is true in a community property state. Community debt in a community property state is collectible from a spouse. Essentially, a spouse’s property and debts are separate in Kentucky but not in California. A bankruptcy attorney has to be careful in any bankruptcy filing to protect the spouse when there are joint debts. Chapter 13, which repays 100% of joint debts, protects the spouse with a co-debtor stay. Any law firm should cover this with you when you review a bankruptcy filing.

Filing Separately and The Means Test

Your household expenses and household income will determine whether you qualify or not under the means test for Chapter 7. It does not matter if it is a spouse’s separate debts or yours as long as it is reasonable. Car loans are allowed if it is your car loan. When your spouse owns an auto, it may or may not be allowed as a necessary expense depending on whether it is a luxury item or necessary. Your bankruptcy lawyer will or should review this.

Using an Experienced Attorney Will Help You to Handle the Situation!

Advertising is not the way to choose an attorney. Will attorneys evaluate the case according to what is best for you or your spouse? If you need to save nonexempt property, you may need to file a Chapter 13. When you file your bankruptcy case, you still use the total monthly income to calculate whether you can file a Chapter 7. Typically spouses file together.

Marital assets need to be protected when you file for bankruptcy. Federal laws give the trustee the ability to sell non-exempt assets. Whether or not bankruptcy affects the spouse when you file for bankruptcy is an essential factor in how and when you file for bankruptcy.

This is not a time to use an inexperienced attorney or a bankruptcy mill. Contact the experienced bankruptcy to help you with all the bankruptcy filing.

Resources for Bankruptcy

Resources for Bankruptcy

Louisville, Kentucky Bankruptcy Forms

Benefits of a Chapter 7 Bankruptcy • Video

What is the Student Loan Brunner Test?

Filing Chapter 7 & Chapter 13 Bankruptcy

Student Loan Bankruptcy Qualifications

Chapter 11 Business Bankruptcy Information

If you are considering bankruptcy, don’t delay because timing is crucial. I am here to help you. So, contact my office immediately to start the conversation—Nick C. Thompson, Bankruptcy Lawyer: 502-625-0905.

Resources for Bankruptcy

Resources for Bankruptcy