No filing for bankruptcy is a good thing, not bad at all 99% of the time. You get to lose debt and increase your FICO score. The other 1% can be comical when debtors do not follow the rules. You will find a little comedy sprinkled throughout this article.

The good news is that most of you think bankruptcy is wrong. But bankruptcy is a financial tool to increase your personal net worth and improve your credit report when your income and assets are low and debt is high.

Time your Filing

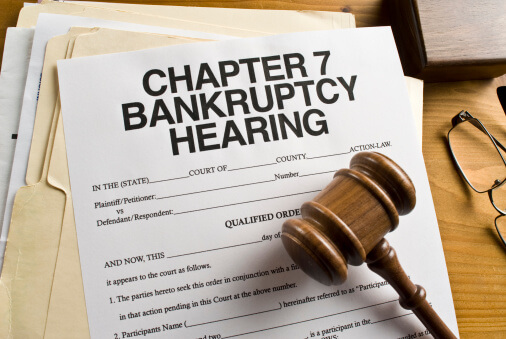

If you are filing for bankruptcy while your credit report score is high, filing for bankruptcy will temporarily lower that score. If you have lots of paid-for assets and a high income, you may be required to file as a Chapter 13 and repay some obligations.

Your financial net worth always increases by unloading debt. Debt causes problems; it doesn’t make life better. Bankruptcy should cure the problem.

When is Bankruptcy a Positive Thing?

Bankruptcy is a positive experience over 90% of the time. It is for the poor unfortunate debtor in a personal situation where someone needs debt relief options. Even an experienced credit counselor does not normally understand all the tools and benefits of a bankruptcy discharge.

People expect a credit score to drop when they file for bankruptcy. But it often increases. Interest rates are lower for persons with low debt-to-income ratios. Even when they erase debts with bankruptcy, the enemy is debt. And typically, nothing decreases debt-to-income ratios and increases credit scores faster than a bankruptcy discharge.

People have the misconception filing bankruptcy is a bad idea. However, if you are considering filing for bankruptcy, you probably have a considerable amount of credit card and unsecured debt. If your credit card debt is maxed out, you can file for bankruptcy and eliminate unsecured debt quickly while improving your credit score. Few people consider bankruptcy court when they have a high income, many assets, and a high credit score.

Why is Filing for Bankruptcy Bad, if it Improves Your Credit Report

Sometimes a Chapter 13 bankruptcy allows you to pay necessary and important debts better. In bankruptcy, necessary expenses like mortgages, child support, and some taxes are repaid long before unsecured creditors are repaid. Some debts don’t go away even if you file bankruptcy, but they can be managed in Chapter 13.

Bankruptcy even allows child support and taxes to be repaid at the expense of debts that are less important. Bankruptcy doesn’t discharge or make non-dischargeable debts uncollectible. Chapter 13 merely attempts to repay or manage these priority or non-dischargeable debts.

Wage garnishments and bank account levies are stopped the moment you file. This allows the poor but unfortunate debtor to get a fresh start on a new budget.

People often go through unforeseen life events. It used to be they could file a new Chapter 7 every seven years. Now you have to wait eight years from the date the first Chapter 7 was filed until the next one is filed. Chapter 7 allows debts like medical and utility bills to be discharged to allow you this “fresh start.”

Bankruptcy as an Educational Tool

Repaying the debt or some part of the debt in a Chapter 13 bankruptcy process allows you to learn to avoid a bad financial situation and decisions. You can increase your net worth overnight and increase your credit scores quickly with a low cost in Chapter 7, but you may not learn these valuable lessons.

If Filing for Bankruptcy Improves Your Net Worth, How Bad is Filing for Bankruptcy?

In a Chapter 7 bankruptcy, the bankruptcy trustee is often looking for assets to take. There is no dismissing your Chapter 7 case if you get into trouble, and the home you said was worth 100,000 is worth 200,000. People most often only tend to have serious problems when they forget and fail to disclose:

- Hidden assets

- Underestimated income sources

- Transferred assets to avoid creditors or the trustee

- Or sold or given away property to avoid creditors and the trustee

They often could have kept property, but because of non-disclosure or creative accounting practices, they lose the property. In Chapter 13, you can dismiss a case if you encounter problems. You can’t dismiss a Chapter 7 case just because the trustee found out you gave your new car to your mother just before filing.

Unexpectedly Losing Property

If your mother put your name on the deed to her home, you own half. Even if you had no knowledge or evil intent, you lose property when you file bankruptcy and fail to disclose or exempt property.

If you are sloppy, the bankruptcy code presumes you had fraudulent intent. Since the trustee earns up to 25% of anything he finds that you did not declare and exempt, you cannot expect him to be charitable and allow you to dismiss the Chapter 7 case just because mom will lose her home.

How Bad is Filing for Bankruptcy after a 7? Can You File Again?

Many people don’t just file one bankruptcy. There is a reason for this. If you file a Chapter 13, the plan will often have to repay 50-70% of the debt you owe to unsecured debts. If you qualify for Chapter 7, you can eliminate all of your unsecured debt before you file Chapter 13.

Filing a Chapter 7 before filing a Chapter 13 means there are no unsecured debts and claims to repay later in Chapter 13. Then you can better manage priority and secured debt like mortgages and income taxes, which are less than three years old, in a subsequent Chapter 13.

A Chapter 13 is more likely to complete if it only has to repay or manage secured obligations like auto loans and home mortgages. This often means you can save thousands by filing the Chapter 7 case first. Filing two cases also maximize the delay if you need to delay a foreclosure filing.

Chapter 20

It is often called filing a Chapter 20 when you file two cases as Chapter 7 and then Chapter 13. (Chapter 7+Chapter 13 = Chapter 20). Chapter 13 then repays 100% because there are no unsecured debts to repay. Plans are automatically approved without a judge reviewing the plan if it pays above a percentage of unsecured debt. This percentage varies from judge to judge. Judges Stout and Merill in my district automatically approve 50% plans. Lloyd is at 70%.

Your personal loans have all been discharged if you file a Chapter 7 first. A 100% Chapter 13 plan makes confirmation and court approval much easier and cheaper.

Waiting Periods and Restrictions

There are some restrictions on how often you can file. For instance, you can only file one Chapter 7 bankruptcy every eight years and obtain the discharge. How long you have to wait is in our book, and it is also a separate page on our website as a chart showing how long you have to wait from one Bankruptcy filing to another.

If you file a Chapter 7, you must wait eight years until you can get your next discharge. But if you don’t need the discharge, there is no waiting period to file a second Chapter 13 case. Often you only need the stay to manage a foreclosure.

Why Filing for Bankruptcy is Bad for Some Credit Scores, Mortgages, and Student Loan Debt

One of the problems with filing bankruptcy is that you must wait two years after a Chapter 7 discharge until you can get a normal mortgage. Almost all government mortgages have this 2-year rule. However, some rare conventional mortgages will require seven years.

Notice having a foreclosure is worse. It will be three years after the home is out of your name before you qualify for a government mortgage after a foreclosure.

Which is Worse, Foreclosure or Bankruptcy?

Foreclosure is always worse on your credit than bankruptcy. Government student loans do not depend on your credit scores. Instead, government student loan debt is granted based on need, not your financial situation or credit reports. Student loans are not denied because you file bankruptcy, but in Chapter 13, you need court approval to obtain debt like mortgages or car loans. Private student loan debt is often based on your credit report.

Filing for Chapter 7 Bankruptcy When Your Credit is Already Bad

After you file bankruptcy, you no longer owe the debt. Negative credit accounts are replaced with notations that the account is closed. The fact that the debt was not paid cannot be reported, and it is not owed after discharge or cannot be collected.

Therefore it cannot be reported as overdue. The bankruptcy may be reported. But your credit will often have multiple notations where accounts are closed, and there should be no notations when an account is in default.

What happens if your score is low when you file will be that it suddenly increases. If your fico score is high, there will be a small drop in your fico score.

What is Bad about Filing for Bankruptcy? A Comedy Moment!

There are some bad consequences of bankruptcy. Because debt collectors are no longer calling, you may worry your phone is broken. I have had clients call, remarking how they repeatedly checked their phones after they filed, thinking the phone was broken because it was not ringing. You may feel lonely.

You will have to live without financial obligations and worry. After the personal bankruptcy is over, you will no longer need aspirin from worrying about overwhelming debt and being over your credit limits. The missed payments, credit bureaus, and high-interest rates will be in the past, and you will have to find something new to worry about.

When is Filing for Bankruptcy a Bad Idea?

Seriously, there are times when filing for bankruptcy is a bad idea. Clients often have the urge to tell everyone about their bankruptcy case. Some ex-partners, ex-wives, and former employees are not your best friends; they know where the assets and secrets are. They can enjoy calling the Trustee with information.

If you are just a poor unfortunate debtor who went through a divorce, death in the family, disability, or discharge from a job, bankruptcy is probably a good idea to recover quickly.

But some clients can have enemies from the past. If these people appear and disclose where hidden assets are, it can cause problems. And they can crop up at unusual places and times. It is rare, but unusual. Unexpected people may show up at a 341 meeting and say some of the silliest things you will ever hear. We had a jeweler show at a 341 asking where a diamond pendant was. The debtor didn’t know. His wife didn’t know either.

When her boyfriend took it back, a professional dancer advised the trustee about a new paid-for auto. No one got to keep the auto.

What Does Everyone Lose When They File for Bankruptcy?

Filing for financial protection with a bankruptcy attorney will take some of your time and money. You can expect to spend about 10 hours or more gathering documents, preparing the petition, and doing credit counseling before filing.

But this is an exchange. You spend about 10 hours preparing what is similar to a budget and an accounting balance sheet. You often lose 20 thousand to 150,000 or more in personal obligations when you file for bankruptcy.

Bankruptcy is not a tool of last resort. Many of the rich recognize it as a financial tool, and just like playing the piano, you get out of it what you put into it. A bankruptcy case is a public record that will not go away. But people who go through a recession, mortgage crisis, pandemic, death, or disability in the family often use bankruptcy attorneys to catch up on mortgage payments or a car loan. Presidents and bank officers have filed.

Why is Filing Bankruptcy for Medical Bills Bad?

Medical debt can often be handled without filing bankruptcy. Bankruptcy law will certainly eliminate medical debt. But often, you can apply for medical waivers that provide relief without declaring bankruptcy. Your Chapter 7 discharge is a precious asset and should not be wasted on minor debts.

Attorneys are happy to give you a free bankruptcy evaluation. They will explain bankruptcy laws to you and show you how to exempt and keep property when you file for bankruptcy. Debt relief may be needed. But often, with medical debt, you can rely upon several programs to waive or pay for unexpected costs without resorting to bankruptcy. Retirement accounts are fully exempted, and a Chapter 7 bankruptcy or 13 does not liquidate retirement accounts.

Call Our Office Chapter 7 & 13 to Get your Present Credit Score Back on Track and Helps You to Obtain New Credit

Everyone has a monthly payment which is hard to meet. How you handle creditors you can’t pay is everything. You get to keep more equity if you plan your bankruptcy and pay the substantial and necessary debt. Legal aid or a local attorney may not have a solution or the answers for you.

Sometimes, you need someone to help set up a debt management plan to pay back the important necessary monthly payments, not the unimportant credit. The bankruptcy code allows a small amount of picking and choosing which debts will survive. This is based on whether you have enough income and whether these expenses are reasonably necessary.

Pick someone experienced bankruptcy attorney for your case. I meet with clients personally to develop a repayment plan. We don’t just hand you off to a paralegal because you, your credit, getting new credit after filing bankruptcy, and your case is important.

Resources for Bankruptcy

Louisville, Kentucky Bankruptcy Forms

Benefits of a Chapter 7 Bankruptcy • Video

What is the Student Loan Brunner Test?

Filing Chapter 7 & Chapter 13 Bankruptcy

Student Loan Bankruptcy Qualifications

Chapter 11 Business Bankruptcy Information

If you are considering bankruptcy, don’t delay because timing is crucial. I am here to help you. So, contact my office immediately to start the conversation—Nick C. Thompson, Bankruptcy Lawyer: 502-625-0905.